FIRPTA for Canadians Selling US Real Estate

Foreign Investment in Real Property Tax Act

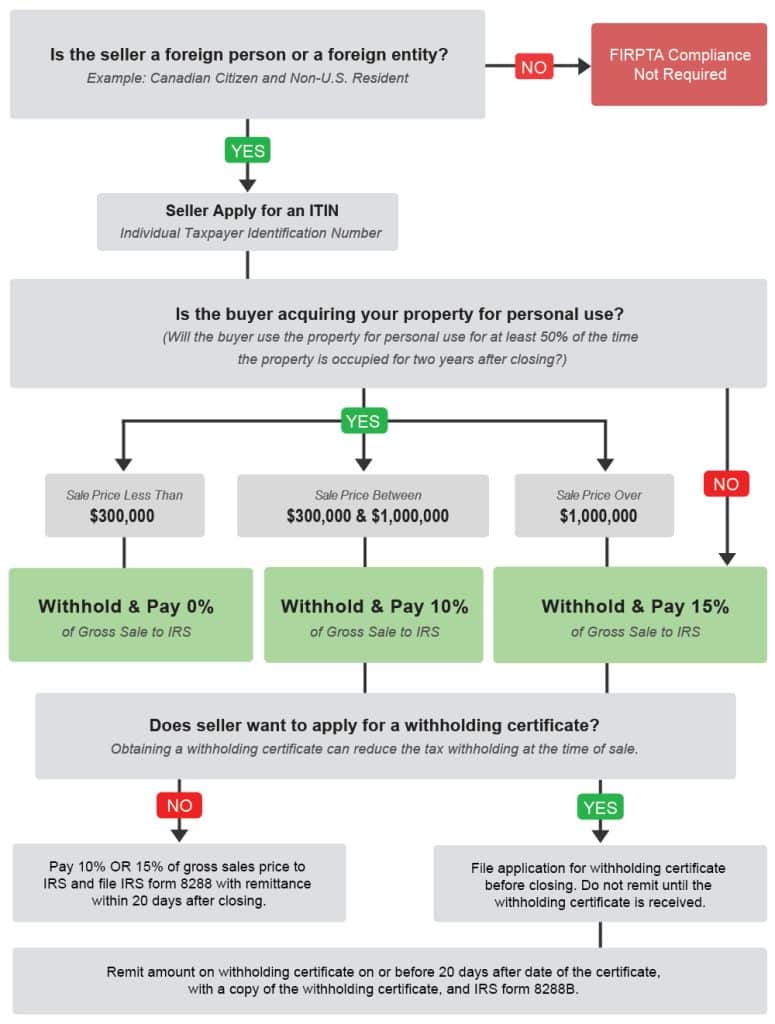

The Foreign Investment in Real Property Tax Act or FIRPTA, applies to the disposition of U.S. real property by foreign owners. Canadians who sell a U.S. property may be subject to a 15% withholding of the purchase price by the IRS. There are ways to reduce or eliminate this withholding tax even if FIRPTA applies. If a seller can prove that his or her adjusted cost basis will reduce or eliminate his or her capital gain so that it amounts to less than 15% of the sale price, a special application can be made to the IRS asking for a reduction or exemption from FIRPTA. Our team has extensive experience working with Canadians and navigating their FIRPTA obligations.

We are the #1 expert team helping Canadians manage FIRPTA in the USA!

We Help Canadians Sell U.S. Real Estate

All-Inclusive Real Estate Services & FIRPTA Planning

We provide our fellow Canadians with expert advice and professional real estate services to Canadians. We take care of Canadians needs to ensure we navigate all the cross border tax hurdles correctly when selling your U.S. real estate.

FIRPTA Tax Withholding

FIRPTA’S objective is to ensure non-resident aliens file U.S. income tax returns and pay taxes on profits generated in the U.S. FIRPTA was instituted to prevent foreign investors from selling U.S. real estate and neglecting to pay any outstanding U.S. tax obligations. FIRPTA prevents this by requiring Federal withholding of 10-15% of the full sale price, regardless of the seller’s profit from the transaction. The deposit is held by the IRS until the seller files income tax returns at the end of the year, at which time any taxes owed are deducted and the balance is refunded to the seller. If no tax is due, the entire amount held is refunded. The seller may also obtain an exemption certificate or waiver from the IRS, in which case the funds can be immediately released.

~ The withholding amount is determined by a number of factors, download our flowchart. ~

How Much Tax Will You Pay?

As a foreign non-resident of the United States, you are required to pay U.S. Capital Gains tax upon selling your U.S. property, if you have a gain in property value. The United States has long-term capital gains tax on profits from the sale of an asset held for more than one year. The long-term capital gains tax brackets listed below depend on your taxable income and filing status. Most Canadians do not have any other U.S. income so your tax bracket is determined by the profit you earn from the sale of the property. But you may have other income to claim such as rental, business, or employment income.

US Long-Term Capital Gains Tax Rates

| Tax Rate | Single | Married – Filing Jointly | Married – Filing Separately | Head of Household |

|---|---|---|---|---|

| 0% | $0 to $40,400 | $0 to $80,800 | $0 to $40,400 | $0 to $54,100 |

| 15% | $40,401 to $445,850 | $80,801 to $501,600 | $40,401 to $250,800 | $54,101 to $473,750 |

| 20% | Over $445,850 | Over $501,600 | Over $250,800 | Over $473,750 |

***Federal tax rates stated by IRS for 2022. State taxes may also apply depending on property location.***

The FIRPTA Process Step-by-Step

for Canadians Selling US Property

We help Canadians every step of the way through the selling process to ensure FIRPTA is managed correctly. We have a highly experienced team of professionals who have worked with FIRPTA for years. This includes cross border tax experts, title companies, and realtors. Having just one part of your sale managed incorrectly can cost you thousands of dollars!